Sears was Amazon before Amazon

The last three decades of retail trends have arguably been led by Wal-Mart, Target and Amazon. Wal-Mart mastered the targeting of mainstream America with the one-stop-shop, bringing together a range of offerings and solutions under one roof. Target developed its differentiated, quality own brands that drove demand and traffic to their stores, and then captured basket filler sales across other categories. And Amazon has offered an endless assortment that can be shopped from home and either delivered or picked up conveniently.

Yesterday we marked another nail in the coffin of the retailer who was Wal-Mart before Wal-Mart, Target before Target and Amazon before Amazon. Sears Roebuck filed for Chapter 11 bankruptcy, planning to shutter another 142 stores, sell off more assets and reorganize as a smaller entity.

Just as Wal-Mart defined convenience and value for its era, Sears offered the suburban mall shopper quality hard and soft goods, automotive care, photo studios, financial, insurance and real estate services all under one roof. What a convenient destination! Just as Target developed trusted value-added own brands, Sears was the only retailer selling top quality Craftsman tools, Kenmore appliances and DieHard batteries. And just as Amazon redefined shopping convenience in the electronic age, Sears did so with the “endless assortment” of its catalog, available to be shipped to the home or picked up at a store's catalog pickup counter (BOPIS anyone?).

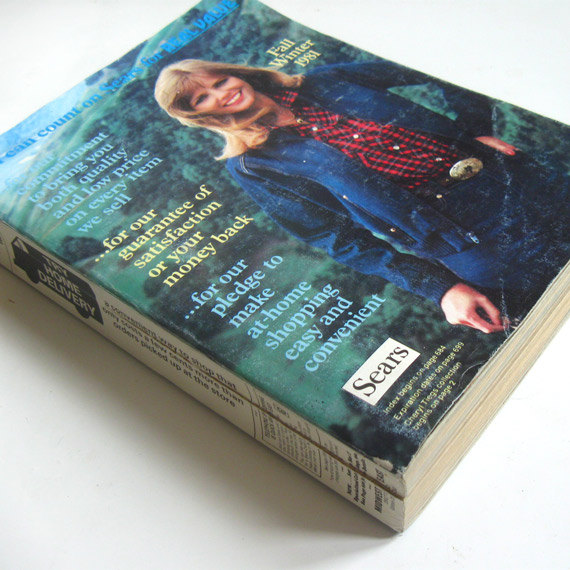

Sears’ Fall/Winter 1981 catalog exclaims: “You can count on Sears…for our commitment to bring you both quality and low price on every item we sell…for our guarantee of satisfaction of your money back…for our pledge to make at-home shopping easy and convenient,” which sounds a whole lot like Amazon’s current mission statement: “We strive to offer our customers the lowest possible prices, the best available selection and the utmost convenience”

So how could a retailer so dominant and innovative for 100 years fall on such hard times? Industry wags have highlighted a long list of missteps contributing to Sears’ arrival at this precipice, from questionable M&A and technology strategy to starved store investment and management hubris. Whether due to ill-conceived strategic intent, calculated gambles gone awry or executional failures, management did not anticipate and adapt to the competitive environment during our most recent disruptive period in American retail.

Regardless of the underlying cause, Sears lost the pulse of its shopper. This failure spanned all of the five “W’s,” and especially the “H;” it was a systemic and complete failure to effectively acknowledge that their old models were obsolete. Over the last two decades, management failed to effectively adapt with regard to:

· Who—the brand and store failed to remain relevant to Boomers, let alone Gen X or Millennials

· What—their merchandise did not materially adapt to style, brand and other consumer trends

· Where—their mall locations became a tightening noose in the post “suburban auto boom” era

· When—beyond 24/7 they missed the desire to shop “when I’m in my pajamas or commuting”

· Why—they failed to see evolving trip missions and the decline of the one-stop stock-up trip

· How—Sears never empowered its customers to shop how they want to…so shoppers went where they were given that control

It’s natural to focus on Sears’ most recent twenty years of furniture-burning life support and lament the failures of the retail icon to adapt to the latest tectonic shift in retail. But let’s not forget to celebrate Sears’ first hundred years of anticipating the opportunities presented by previous environmental changes. Sears foresaw and capitalized on the impact of interstate railway development, the potential of mail order catalogs for an expanding, decentralized populace, the mass adoption of automobiles and suburban malls, the demand for middle class mass production, the loyalty value of credit card control and the leverage of selling both products and services. Some of these developments have come and gone, but many still form a foundation on which today’s successful retailing businesses are built.

In another hundred years, will the industry be celebrating Amazon’s sustained record of adapting to evolving technology capabilities, commercial needs and consumer trends? Or will they be dust in the digital wind, long since surpassed by upstarts in the retail evolution analog of Moore’s Law?