Category Strategy for the Millennial Generation

- Bob Hilarides

- May 10, 2019

- 3 min read

Updated: Sep 24, 2020

Category strategy has hardly changed at most retailers since the Food Marketing Institute unveiled its Category Strategies about 25 years ago. That’s a whole generation ago. We still talk about the Traffic Drivers, Transaction Builders, Profit Enhancers and Cash Generators that the FMI wrote about in 1995. You could actually argue that these building blocks of retail haven’t changed over the last 100 years. That makes them the stuff of Great Great Grandparents.

The building block strategies were supplemented with other strategies informed by the environmental trends of the day. The FMI thus brought us the Turf Protectors strategy, noting the emergence of retailer “Category Killers” like pet specialty, beauty and natural foods. Evolving consumer trends like organic, health and convenience suggested the value of a strategy for Image Enhancers. And blurring channel lines drove a focus on urgency and differentiation, resulting in the Excitement Creator strategy.

So does the fact that we're still using that same language mean that environmental conditions haven’t changed much over the last 25 years?

Let’s dial up Mr. Peabody’s WABAC machine and take a look back at the retail world of 1995.

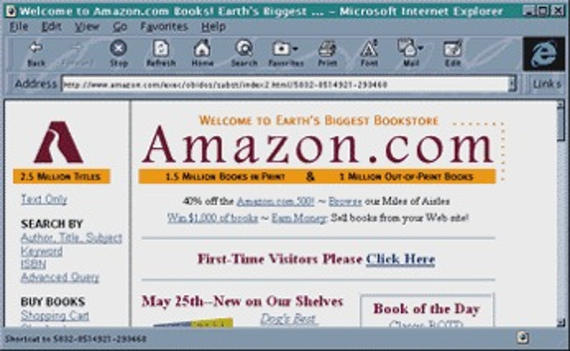

Amazon was a private company shifting from beta to the public marketing of books (remember books?)

Lou Carbone had just coined the phrase “Customer Experience” in Marketing Management magazine (remember magazines?)

The main thing people bought through subscription was the newspaper (remember newspapers?)

Cell phones were evolving from the brick to the flip, but they were still pretty much just phones (you could only order a pizza with one if you’d memorized the restaurant’s phone number)

And Category Managers were rationalizing “tertiary brands” to focus on 1-2 big national players and Private Label (disruptive Challenger Brands were percolating in tweens’ heads)

These quaint 1995 mileposts suggest that the marketplace has changed about as much as millennials have over the last 25 years, most notably due to the digitally-driven commercial democratization that has given the shopper more power in the relationship with the retailer or manufacturer. These changes call for strategies that better integrate omni channel marketing, leverage the store experience and focus expensive retail space on items that benefit most from in-store presence.

Today’s millennial shopper has visibility to the long tail of the assortment, and is able to select just the right product to meet her wishes, all the way to complete personalization. She can weigh the convenience of a mobile order/delivery with a trip to the store. Or subscribe for regular delivery of some staples with a set and forget program. Her interest in healthy or conscientious products from local or smaller brands can be met in almost every category of the store. And if the price at the shelf feels high, she can shop other stores on her phone before deciding to make a purchase (or not!).

So today’s retail environment calls for the introduction of some new strategy classifications, like the Predictable Staples strategy for categories like dry dog food, detergent and paper goods with regular use up rates and low individual need for variety but higher need for range across shoppers. Such items are ripe for e-commerce conversion with competitive pricing and auto-ship tactics, and then rationalized space and assortment in-store.

Personal Touch is another new strategic class relevant for today’s retail environment. These high engagement product and service categories require or benefit from physical presence in the store, either to engage with the product, gain counsel from store associates or receive the service in store. Meat departments, pet grooming, hair styling and prepared foods are examples of Personal Touch categories. Such items can differentiate the store and should be prominently featured in store location, associate training, loyalty program development, etc.

Different retail “channels” and corporate strategies will guide other new strategic buckets as well, for instance a Showroom strategy where retailers can capture share of bigger, more complicated purchases, or a First Timer strategy that can serve as a destination for high future-value shoppers just entering a life phase or need state, like new pet owners or Gen Z tweens exploring beauty categories.

Smart manufacturers and retailers need to revisit the way they talk about the role that different categories, brands and sku’s play in today's omnichannel retail environment. Incorporating shoppers’ new relationships with the store and the brand will highlight different ways to optimize the presentation of a category online and in store. Quantitative metrics can determine the strategy for each product, and lead to more compelling and efficient retail environments.

For more information on how we can help you refine your Category Strategy, call Bob Hilarides at (847) 917 5121 or explore KnowledgeAmp.com.

コメント